Tax Planning

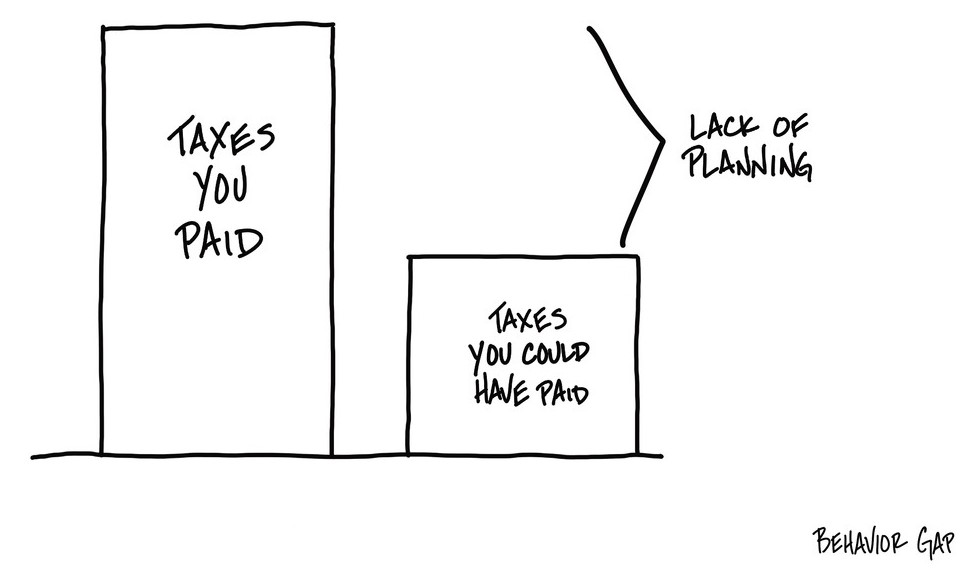

Without careful planning, it’s very possible to have a higher tax bill in retirement than as a working professional.

Tax Reduction Questions sound like…

- Am I paying too much in taxes?

- How do my investment decisions affect my tax bill?

- When will tax rates go up?

- Should I convert my IRA to Roth?

Our tax planning services aim to help keep taxes low today and in retirement. We accomplish this through:

- Annual Tax Return Analysis

- Annual Roth Conversions

- Coordination & Timing of Income Streams (e.g. Pension, Social Security, Required Minimum Distributions, etc.)

- Asset Location

- Charitable Giving Strategies

We also stay up-to-date with the ever-changing tax laws to ensure you are taking advantage of every opportunity. We can also recommend qualified tax-preparation specialists to help you file your taxes and work in coordination with our strategies to help plan for a tax efficient retirement.

👉 Want to learn more about lowering your tax bill in retirement? Click here to get your Free Retirement Assessment.